H1b tax calculator

FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. If you make 70000 a year living in the region of South Carolina USA you will be taxed 12409.

Us Tax Filing 2022 For 2021 H1b L1 H4 L2 Updates Deadline Rates E Filing Redbus2us

Answer 1 of 3.

. The Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. Ad Free Avalara tools include monthly rate table downloads and a sales tax rate calculator. There are lot of online sites which help you with this.

Generally an alien in H-1B status hereafter referred to as H-1B alien will be treated as a US. See where that hard-earned money goes - with Federal Income Tax Social Security and other. If you become a US resident you will have access to those deductions but you will also be charged on your worldwide income.

That means that your net pay will be 45925 per year or 3827 per month. Download Avalara sales tax rate tables by state or search tax rates by individual address. South Carolina Income Tax Calculator 2021.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here. Resident for federal income tax purposes if he or she meets the Substantial.

The federal tax for H1B employees ranges from 10 to 37. Answer 1 of 4. According to US tax laws if you are a US resident who also holds an H1-B visa you are required to pay tax.

Your average tax rate is 1198 and your. Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. Your average tax rate is.

The US tax rate for individual ranges from 10 to 396 depending on your income level. First enter your Gross Salary amount where shown. Using the United States Tax Calculator is fairly simple.

Most unmarried H1B workers will pay a rate of 25-28 on taxable income the amount. They pay Federal state SSN Medicare and any other taxes applicable. Only difference is 1.

Easily E-File to Claim Your Max Refund Guaranteed. The H-1B visa is one of the most sought-after US visas for foreign. Discover Helpful Information And Resources On Taxes From AARP.

Now if you make about 120000 per year or 10000 per month for sake of simplicity below is how much you can. Savings with an average salary of 5000 per month. Prevailing Wage Level Calculator for H-1B H-1B1 E-3 and H-2B Visas and PERM Labor Certification.

Your income level determines the tax rate which. The H-1B Visa Cost Calculator helps employers calculate the fees they will need to pay to sponsor H-1B visa applicants. This is a great H1-B tax saving.

A sales tax is a consumption tax paid to a government on the sale of certain goods and services. The one I use is below. If you make 55000 a year living in the region of Texas USA you will be taxed 9076.

Estimate your tax withholding with the new Form W-4P. The Salary Calculator for US Salary Tax Calculator 202223 - Federal and State Tax Calculations with full payroll deductions tax credits and allowances for 2022 and 2021 with detailed. Use Notice 1392 Supplemental Form W-4 Instructions for Nonresident Aliens.

Usually the vendor collects the sales tax from the consumer as the consumer makes a. Pay tax on your worldwide income. Ad Calculate Your 2022 Tax Return 100.

H1b visa holder salary is taxed same as any US citizen or Resident. On an H1B visa you have to pay Federal State Social Security and Medicare tax based on your income. You have nonresident alien status.

The standard FUTA tax rate is 6 so your max. Salary Paycheck Calculator Payroll Calculator Paycheck City It helps you calculate your net. Next select the Filing Status drop down menu and choose which option applies.

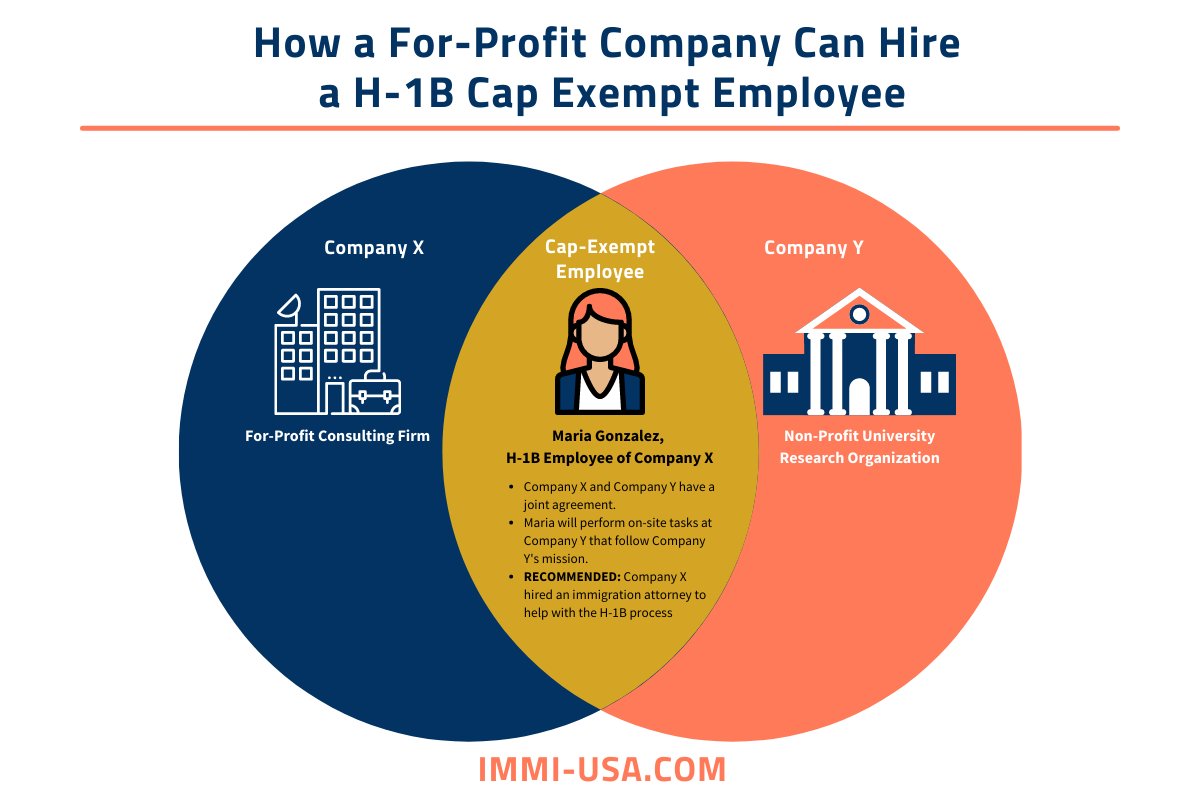

H 1b Cap Exempt Rules Employers And Process 2022 23

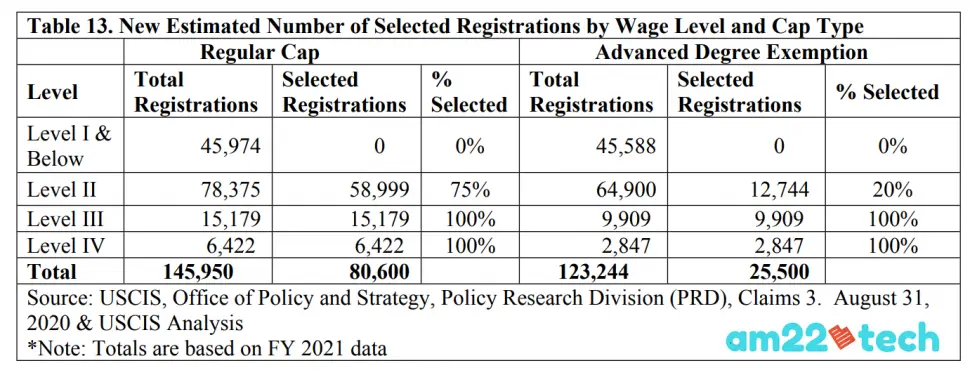

H1b Lottery Chances What H 1b Lottery Results Say About Odds 2022

Automatic Visa Revalidation Avr Within 30 Days Canada Mexico Usa

Filing Taxes On H1b Visa The Ultimate Guide

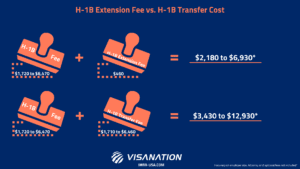

H 1b Fees Who Pays For What And How Much Updated 3 28 22

Tax Refunds Of Nonimmigrant Workers In The Us Taxes For Expats

H1b Salary Comparably

What Is H1b Lottery System Chances Of Selection In Apr 2021 Usa

Am22tech Usa Australia Canada Immigration Visa Money Green Card Application Visa Visa Card

Chances Of H1b Approval After Lottery 2021 22 Denial Rfe Steps Usa

This Is How Much Money You Save On H1b L1 Visa In Us 2022

H1b Lottery Chances What H 1b Lottery Results Say About Odds 2022

How Much Will I Pay In Income Tax While Working On An H1b In The Us

H1b Lottery By Wage Level Delayed Till Dec 2021 Am22tech

Current H1b Processing Time 2022 Estimate Approval Usa

Can H1b Work From India Canada And Get Salary In Usa Usa

This Is How Much Money You Save On H1b L1 Visa In Us 2022